As I was performing my daily review of affiliate transactions in a client’s account, I’ve realized that every time I’m doing this, I subconsciously look for specific things. These range from bad to good ones — from red flags to opportunities. Today, I’d like to share with you what I am typically looking for.

As I was performing my daily review of affiliate transactions in a client’s account, I’ve realized that every time I’m doing this, I subconsciously look for specific things. These range from bad to good ones — from red flags to opportunities. Today, I’d like to share with you what I am typically looking for.

1. Violations

While most violations of your affiliate program’s policies will be caught by specific compliance policing tools, your routine review of affiliate transactions may yield additional insights.

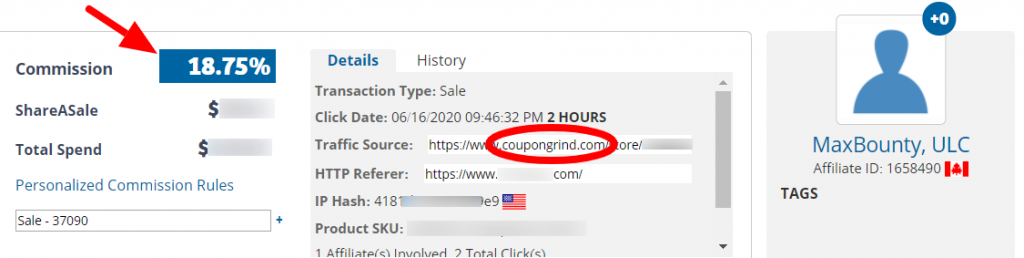

If, for instance, your affiliate compensation terms are different for different types of affiliates, look for bypasses. A classic example would be that of an affiliate, who is either paid less or is banned from your affiliate program, using a content monetization platform (or another mediator) to mask themselves.

Above you may find a real-life illustration of the situation where a coupon affiliate (who is supposed to be paid 5%) is, actually, getting a much higher commission by linking indirectly but via a mediator.

2. Inconsistencies

Whether it is a wrong commission rate or anything else that’s inconsistent with the agreement that you have with a specific affiliate, keep an eye out for these as you perform your routine review.

3. Red Flags

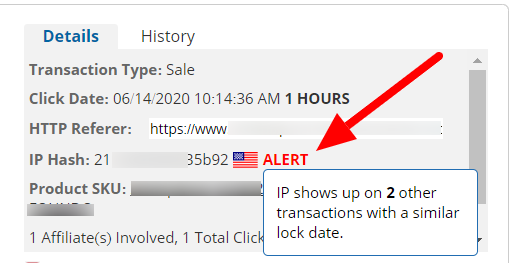

Depending on the platform that you use, your review of affiliate-referred transactions may reveal certain red flags.

Below you may find an example of how on ShareASale merchants see an alert when the same IP was used on transactions that have a similar lock date.

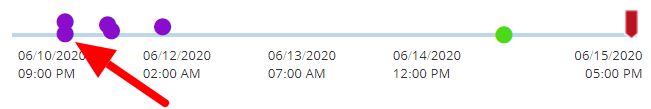

Another case would be the below-illustrate spike in conversions (registered on CJ).

As mentioned elsewhere “any spike (in traffic, leads, sales, conversion rate, or anything else) should raise a red flag”. Spikes are not always indicative of violations or affiliate fraud. But they always call for an additional dissection and analysis.

4. Activations

When you see an affiliate’s first conversion come through, it’s a great time to reach out to him/her with personal congratulations and encouragement to press on.

Go out of your way and also analyze how they drove the sale, thinking of what they could do to drive more action.

…and you better have a goodfirst-sale/conversion bonus in place too! These are always great in motivating stagnant affiliates to activate.

5. Optimization Opportunities

Finally, as you examine affiliate transactions, ideas on optimization opportunities should also surface. Put yourself in your affiliates’ shoes and think of ways for them to make more money with you.

Here is an illustration of a pretty common scenario (where multiple affiliates touch the same buyer along their shopping journey):

The purple dots represent every affiliate touch, while the green dot stands for the “commissioned click” (or the one for which the last-to-touch affiliate got paid).

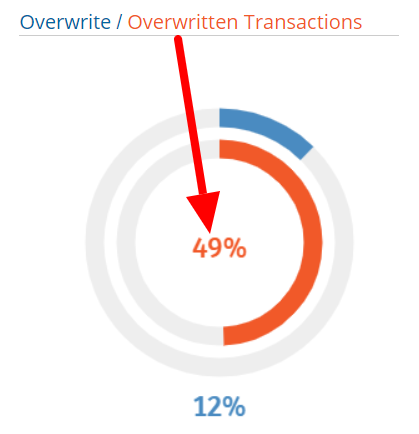

Diving deeper (and thank you, ShareASale for the technology to give us these great insights), we noticed that the affiliate who was the first to touch this buyer, has his cookies overwritten much more frequently than he overwrites other affiliates’ cookies (see the donut charts below).

Moving this particular affiliate to first-click attribution was a common-sense conclusion. Having discussed this with the affiliate, we’ve had the affiliate network “prioritize” this affiliate’s cookies. Now, every time that he introduces a customer, he is the one who gets the commission for that customer, regardless of how many (other) affiliates touch the same customer before he/she buys.

Of course, this is just one optimization idea. You’ll come up with many more if you approach your analysis in a thoughtful and affiliate-friendly manner.

If you need help in anything related to affiliate marketing and/or affiliate program management, hit me up directly.

If you’re an affiliate program manager yourself, do chime in (via the “Comments” section below) to share what your are looking for while reviewing and analyzing your affiliates’ transactions.