A couple of weeks ago we launched a new affiliate program. It’s a program for a subscription-based product, with the sales process starting with a free trial. When setting up affiliate programs for such businesses, the rule of thumb is to intertwine two payment models:

- PPL (pay-per-lead) on each free trial driven in by an affiliate

- PPS (pay-per-sale) on each trial converted into a paying subscriber

With any pay-per-lead affiliate program there’s always a risk of receiving fake leads, but the beauty of affiliate marketing is that merchants pay only for qualified referrals. With proper affiliate program management, ultimately, all phony leads result in reversals of affiliate payouts, but how do you prevent these?

One way would be to pay attention to the affiliates’ promotional techniques as you review their profiles at the application stage.

Three Red Flags

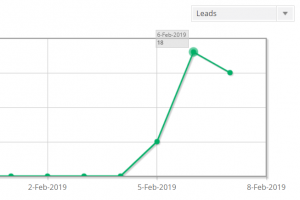

Let me return to the story with which I have started this post. A couple of weeks after launching this new affiliate program, we registered a noticeable spike in the leads referred by affiliates.

In affiliate marketing, any spike (in traffic, leads, sales, conversion rate, or anything else) should raise a red flag. It may not necessarily indicate fraud, but it does call for additional analysis.

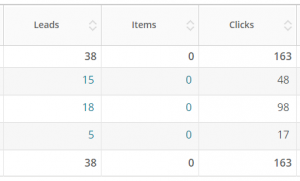

Reacting to the spike, we looked into it a bit more, and found out that all of these leads were referred by one affiliate (red flag #2).

We also reached out to the client — for them to look into the quality of these 38 leads. The client replied quickly, notifying us that a large chunk of these were actually fake (red flag #3) with “John Doe” put into the name field, and other sure indicators of phony leads.

Incentives and How They Work

While we were waiting on the client’s response, we studied the affiliate in a bit more detail. It turned out that, regardless of positioning themselves as a monetization platform, they were actually a classic rewards or loyalty affiliate.

Rewards affiliates (sometime also called “incentive affiliates” or “loyalty affiliates”) drive incentivized traffic. This, basically, means that the person referred by such an affiliate is motivated by an incentive. As our friends at BrandVerity explain, incentives may come in an array of forms:

- Cashback

- Miles

- Points

- Virtual currency

- Prizes

- Cash

These incentives are given to the end-user in exchange for the desired action (on the business’ website).

Misaligned Intent

So, what happened in our client’s affiliate program was a fundamental dissonance between the affiliate’s primary technique and the merchant’s ultimate goal.

The “rewards” component of the affiliate’s strategy resulted in misalignment between the end-user’s intent and the the merchant’s intent. As the above description (of the situation) shows, many of the forms were filled out in order to receive the promised incentive, and not because of the lead’s genuine interest in trying out the product.

The “rewards” component of the affiliate’s strategy resulted in misalignment between the end-user’s intent and the the merchant’s intent. As the above description (of the situation) shows, many of the forms were filled out in order to receive the promised incentive, and not because of the lead’s genuine interest in trying out the product.

Bottom line: if you run a pay-per-lead affiliate program, be careful with incentivized traffic. Most of it may be of no good to you.

Should you need any help with anything related to affiliate programs, contact us and we’ll be happy to assist.

In which case could a spike on sales due to an incentive be genuine ?